- M-F: 9am - 5pm; Sat: By Appointment

by Bill Counts, MBA | May 19, 2018 | short term care insurance, short-term care insurance

.jpg)

Some would like long-term care insurance (LTCi) but feel they have waited too long. They feel they are too old, unhealthy, or can’t afford the cost. They may have been previously declined. There are others who have assets, but want time to plan the financial consequences of care. Short-term care insurance (STCi) is a good option.

So, what is short-term care insurance? Qualification for benefits are the same as LTCi, inability to perform two activities of daily living (ADLs) or cognitive impairment. Maximum benefit period is less than one year (360 days). This is not bad. Depending on the source, 40-50% of LTCi claims are one-year or less. Also, policies have a great feature called restoration of benefits. If the policy owner recovers and does not receive care for 180 days, complete benefits are restored one time.

In summary, here are reasons to consider Short-term Care Insurance:

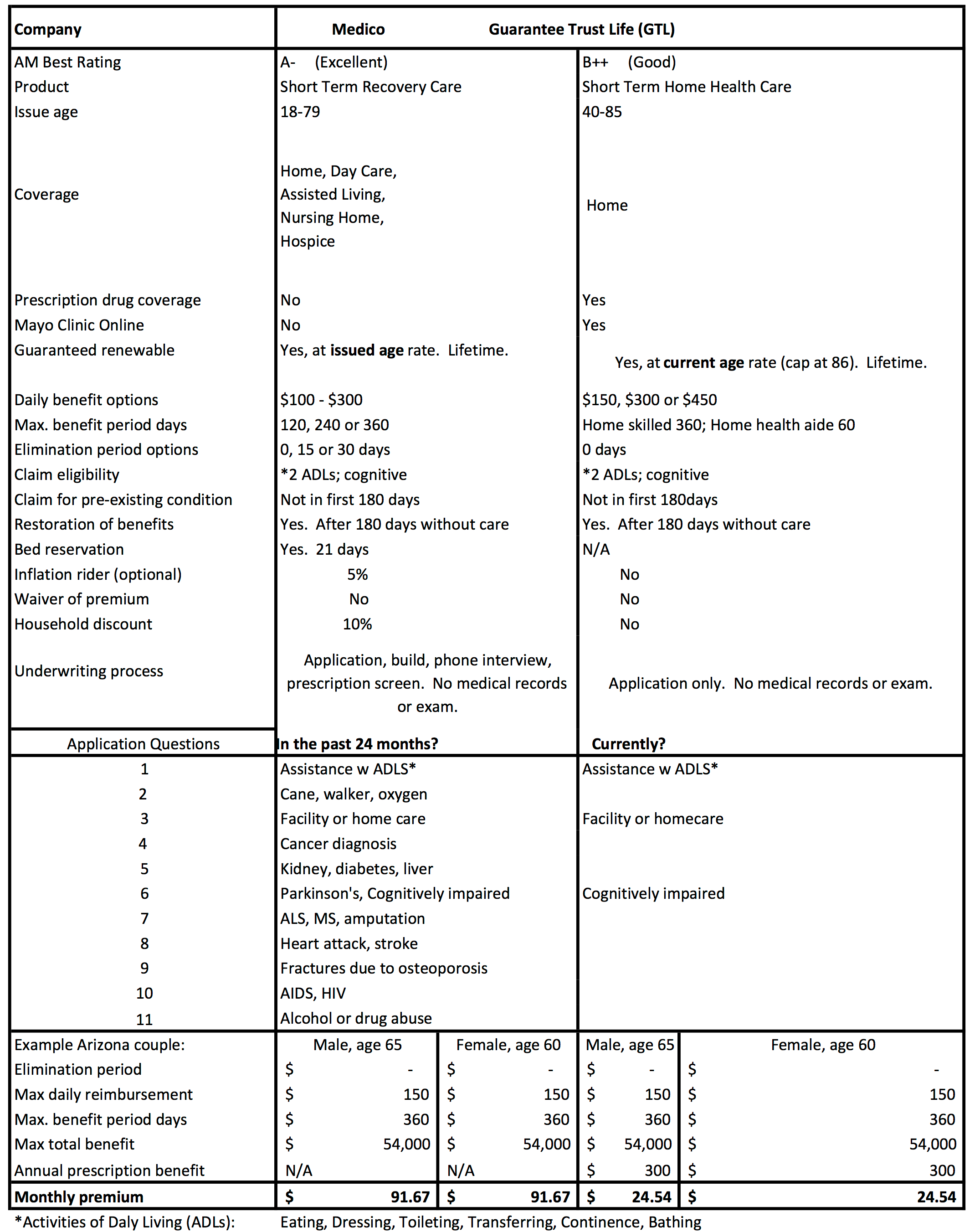

Following is a comparison from two carriers for a 65-year old Arizona couple. Contact [email protected] for a specific quote.